If you were to manufacture 100 new cups, your total variable cost would be $200. However, you have to remember that you need the $20,000 machine to make all those cups as well. However, the growing trend in many segments of the economy is to convert labor-intensive enterprises (primarily variable costs) to operations heavily dependent on equipment or technology (primarily fixed costs). For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s.

Using the contribution margin formulas – example

As you can see, contribution margin is an important metric to calculate and keep in mind when determining whether to make or provide a specific product or service. They can use that information to determine whether the company prices its products accurately or is likely to turn a profit without looking at that company’s balance sheet or other financial information. You can use contribution margin to help you make intelligent business decisions, especially concerning the kinds of products you make and how you price those products. Imagine that you have a machine that creates new cups, and it costs $20,000.

- Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

- My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

- This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit.

- Accordingly, these costs increase with the increase in the level of your production and vice-versa.

- The gross sales revenue refers to the total amount your business realizes from the sale of goods or services.

Income Statement

Furthermore, this ratio is also useful in determining the pricing of your products and the impact on profits due to change in sales. Accordingly, in the Dobson Books Company example, the contribution margin ratio was as follows. Thus, the contribution margin ratio expresses the relationship between the change in your sales volume and profit. So, it is an important financial ratio to examine the effectiveness of your business operations.

Would you prefer to work with a financial professional remotely or in-person?

This \(\$5\) contribution margin is assumed to first cover fixed costs first and then realized as profit. For variable costs, the company pays $4 to manufacture each unit and $2 labor per unit. Companies often look at the minimum price at which a product could sell to cover basic, fixed expenses of the business. Fixed expenses do not vary with an increase or decrease in production. They include building rent, property taxes, business insurance, and other costs the company pays, regardless of whether it produces any units of product for sale. You’ll often turn to profit margin to determine the worth of your business.

In other words, your contribution margin increases with the sale of each of your products. Remember, that the contribution margin remains unchanged on a per-unit basis. Whereas, your net profit may change with the change in the level of output. Thus, you need to make sure that the contribution margin covers your fixed cost and the target income you want to achieve. We’ll next calculate the contribution margin and CM ratio in each of the projected periods in the final step.

The addition of $1 per item of variable cost lowered the contribution margin ratio by a whopping 10%. You can see how much costs can affect profits for a company, and why it is important to keep costs low. Contribution margins are often compared to gross profit margins, but they differ. Gross profit margin is the difference between your sales revenue and the cost of goods sold. Fixed costs usually stay the same no matter how many units you create or sell. The fixed costs for a contribution margin equation become a smaller percentage of each unit’s cost as you make or sell more of those units.

Now, it is essential to divide the cost of manufacturing your products between fixed and variable costs. However, ink pen production will be impossible without the manufacturing machine which comes at a fixed cost of $10,000. This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced.

If the selling price per unit is more than the variable cost, it will be a profitable venture otherwise it will result in loss. Variable costs fluctuate with the level of units produced and include expenses such as raw materials, packaging, and the labor used to produce each unit. The result of this calculation shows the part of sales revenue that is not consumed by variable costs and is available to satisfy fixed costs, also known as the contribution margin. Using this formula, the contribution margin can be calculated for total revenue or for revenue per unit. For instance, if you sell a product for $100 and the unit variable cost is $40, then using the formula, the unit contribution margin for your product is $60 ($100-$40).

After all fixed costs have been covered, this provides an operating profit. Consider its name — the contribution margin is how much the sale of a particular product or service contributes to your company’s overall profitability. It’s how valuable the sale of a specific product or product line is. The variable costs equal $6 because the company pays $4 to manufacture each unit and $2 for the labor to create the unit. Increase revenue by selling more units, raising product prices, shrinking product size while keeping the same cost, or focusing on selling products with high margins.

A business can increase its gmail integration integrate with your business apps for free by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs. The contribution margin is affected by the variable costs of producing a product and the product’s selling price. Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits.

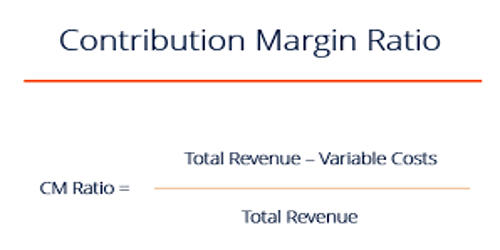

For example, if the cost of raw materials for your business suddenly becomes pricey, then your input price will vary, and this modified input price will count as a variable cost. The resulting ratio compares the contribution margin per unit to the selling price of each unit to understand the specific costs of a particular product. The contribution margin ratio refers to the difference between your sales and variable expenses expressed as a percentage. That is, this ratio calculates the percentage of the contribution margin compared to your company’s net sales. This means that you can reduce your selling price to $12 and still cover your fixed and variable costs. To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit.