The net amount is recorded as either a debit or a credit, depending on whether the company paid more or less than the shareholders did originally. When shares are repurchased, the treasury stock account is debited to decrease total shareholders’ equity. If the treasury stock is resold later, the cash account is increased through a debit while the treasury stock account is decreased. This increases total shareholders’ equity through a credit notation on the balance sheet.

How Treasury Stock Is Recorded

This expenditure can impact the company’s liquidity, particularly in the short term, as cash flow may become tighter. Therefore, companies usually conduct a careful cash flow assessment before deciding on a buyback to ensure that core operations won’t be affected and that unexpected funding needs can be met. In either method, any transaction involving treasury stock cannot increase the amount of retained earnings. If the treasury stock is sold for more than cost, then the paid-in capital treasury stock is the account that is increased, not retained earnings. In auditing financial statements, it is a common practice to check for this error to detect possible attempts to “cook the books”. Treasury stock is used by companies to boost shareholder value and improve financial performance.

MANAGING YOUR MONEY

These shares were initially issued to the public but have since been reacquired by the company, and they are now held in the company’s treasury. Companies buy back their shares for a variety of reasons, which include boosting the share price, the earnings per share, consolidation of ownership, reducing the cost of capital, and providing an increase in value to investors. The explanation that firms typically offer is that reducing the amount of stock in circulation boosts shareholder value. Contra-equity accounts have a debit balance and reduce the total amount of equity owned – i.e. an increase in treasury stock causes the shareholders’ equity value to decline. Or, a company’s treasury stock may have never been issued to the public at all, and was simply created when the company’s shares were first issued.

Example of the Constructive Retirement Method

Accompanying the decrease in the number of shares outstanding is a reduction in company assets, in particular, cash assets, which are used to buy back shares. There are a few potential benefits for companies that buy back their own shares. First, it can help to boost the value of the remaining shares by reducing the number of outstanding shares. This can make the stock more attractive to investors and help to drive up the share price.

This arrangement permits the corporation to retire the shares and avoid future dividend payments. The debit to Retained Earnings reflects the position that the $8,000 was paid to satisfy stockholder claims that had arisen through operating activities subsequent to the issuance of the shares. His background includes a career as an investments broker with such NYSE member firms as Edward Jones & Company, AG Edwards & Sons and Dean Witter. He helped launch DiscoverCard as one of the company’s first merchant sales reps. Share buybacks can also be used as a defensive tactic against hostile takeovers.

- When a business is first established, its charter will cite a specific number of authorized shares.

- In this journal entry, there is no impact on total equity on the balance sheet as the debits and credit are all in the equity section.

- These shares are issued by the company to the public and provide shareholders with ownership in the company, voting rights on corporate matters, and eligibility to receive dividends.

- By increasing the value of the shareholders’ interest in the company (and voting rights), the repurchase of shares helps fend off hostile takeover attempts.

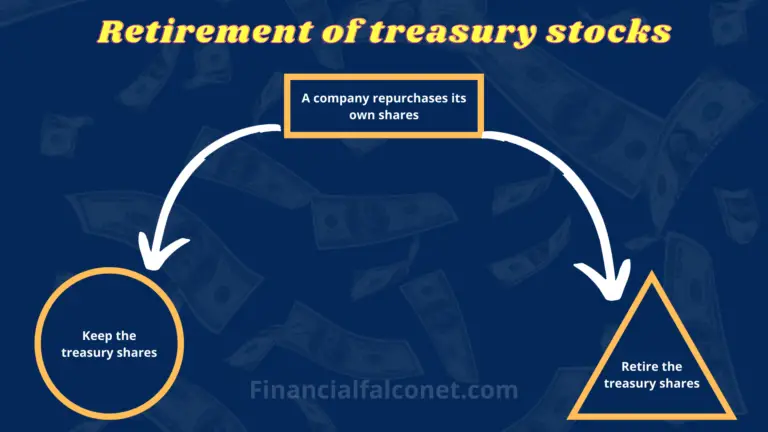

What happens when shares are retired?

First, the amount of treasury stock is generally limited by state law to the balance of retained earnings. By purchasing shares from stockholders, the corporation can use them, for example, as part of the compensation to executives without having to go through the legal difficulties of amending the Charter to allow additional shares to be issued. Treasury stock is the corporation’s own capital stock, either common or preferred, that has been issued and subsequently reacquired by the firm, but not canceled. Offering stock to the public is often an effective way to raise capital, but there are certain times when a company may want to reign in the number of shares circulating on the open market. One common reason behind a share repurchase is for existing shareholders to retain greater control of the company. If the shares are priced correctly, the repurchase should not have a material impact on the share price – the actual share price impact comes down to how the market perceives the repurchase itself.

In a buyback, a company buys its own shares directly from the market or offers its shareholders the option of tendering their shares directly to the company at a fixed price. A share buyback reduces the number of outstanding shares, which increases both the demand for the shares and the price. The essential difference between dividends and treasury stock is that all shareholders receive cash when dividends are issued, but only income and expenditure health and social care stockholders who resell the stock to the corporation receive cash from treasury stock transactions. The number of issued shares and outstanding shares are often one and the same. But if the company performs a buyback, the shares designated as treasury stock are issued, but no longer outstanding. Additionally, if management eventually decides to retire the treasury stock, the amount is no longer considered issued, either.

A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – or from 11 Financial upon written request. Most large discount brokerages are able to help clients track down securities that have been defunct for over 10 years. With the CUSIP number, the brokerage can uncover all splits, reorganizations, and name changes that have occurred throughout the company’s history. It can also tell you whether the company is still trading or out of business. Let us imagine a world where TechnoCorp, a renowned tech giant based in Zephyria, announced its plan to retire a significant portion of its shares in 2023.

Once shares are retired, they cannot be reissued, and no longer have any financial value nor do they represent any ownership in the company. On other occasions, the board may decide that shares of treasury stock should be formally retired and thus removed from the issued category. Due to double-entry bookkeeping, the offset of this journal entry is a debit to increase cash (or other asset) in the amount of the consideration received by the shareholders. These shares are repurchased and retired, resulting in fewer shares outstanding.